Stamp Duty For Tenancy Agreement Malaysia 2019

Can i print the digitally signed tenancy agreement and use it for stamp duty at the tax office.

Stamp duty for tenancy agreement malaysia 2019. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the. Compute the stamp duty payable. Chat property malaysia author.

2019 27 411 904. Tenant period is start from june 2019 till june 2020 may i write date of tenancy at 15th apr 2019 and go for stamping on apr 19. Rm500 001 and above 2020 stamp duty scale from 1st july 2019.

April 17 2019 at 4 01 pm reply. Gst f7 calculator xls 561 kb determine eligibility for correcting past gst submission errors in next period s returns and calculating the values towards filing consolidated f7 returns. Stamp duty on any instruments of an asset lease agreement executed between a customer and a financier made under the syariah principles for rescheduling or restructuring any existing islamic financing facility is remitted to the extent of the duty that would be payable on the balance of the principal amount of the existing islamic financing facility provided instrument for existing islamic.

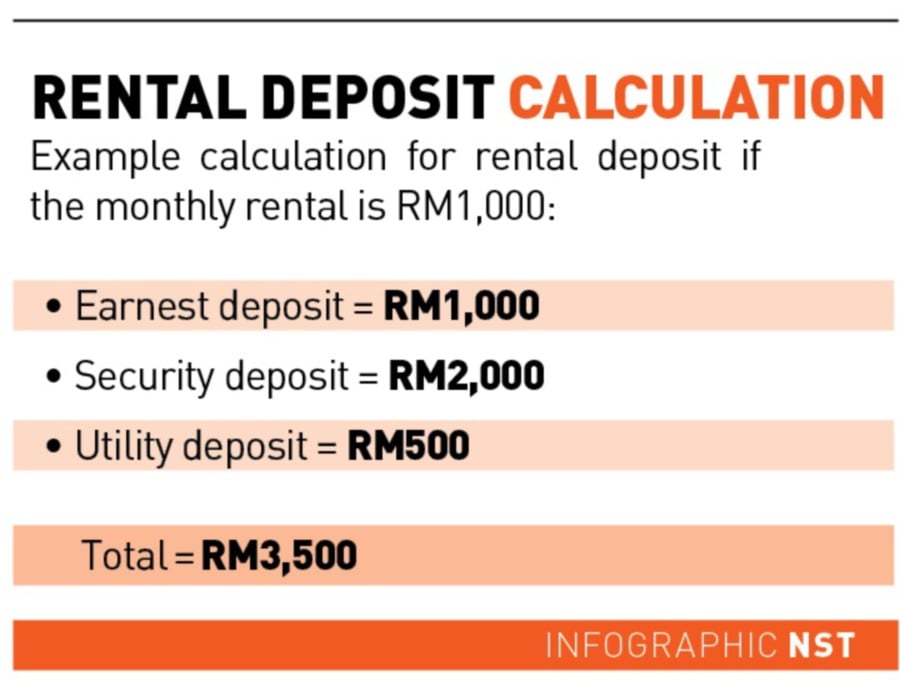

To use this calculator. 2019 stamp duty scale from 1st january 2019 30th june 2019 stamp duty fee 1. November 6 2019 july 27 2020 alicia 5 comments rental agreement rental calculator stamping fee tenancy agreement tenant importance of tenancy agreement stamping tenancy agreement i s a printed document that states all the terms and conditions which the tenants and landlords have agreed upon before the tenant moves in.

Home calculators tenancy agreement stamp duty calculator. Determine when your business is liable for gst registration from calendar year 2019 onward. I got the following table from the lhdn office.

Rm100 001 to rm500 000 stamp duty fee 3. An instrument is defined as any written document and in general stamp duty is levied on legal. Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan the calculation formula for legal fee stamp duty is fixed as they are governed by law.

Tenancy period 3 years payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480 figures will be rounded up step 4. For first rm100 000 stamp duty fee 2. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement.

Tenancy agreement stamp duty calculator. How to open trading and cds account for trading in bursa malaysia. Sale and purchase agreement malaysia.

Rm500 billion in debt is the malaysian government bankrupt. In summary the stamp duty is tabulated in the table below. About chat property malaysia.

All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who shall assess the duty chargeable.