Sst Exemption Schedule A

We will outline how each schedule types may apply for exemption.

Sst exemption schedule a. The sst exemption approval will be granted with a certificate. The earlier of payment made or invoice received date. Online or manual submission.

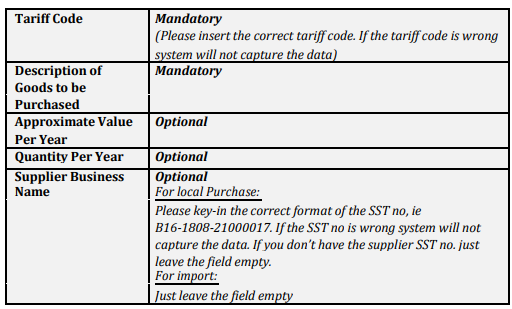

This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. Manufacturer of specific non taxable goods exemption of sales tax on acquisition of raw materials components packaging etc. The application process is as follows.

Log in using username and password ii choose exemption menu iii choose type of exemption under schedule c. Application for exemption of sales tax under schedule c. The developing and printing of photographs and the production of film slides.

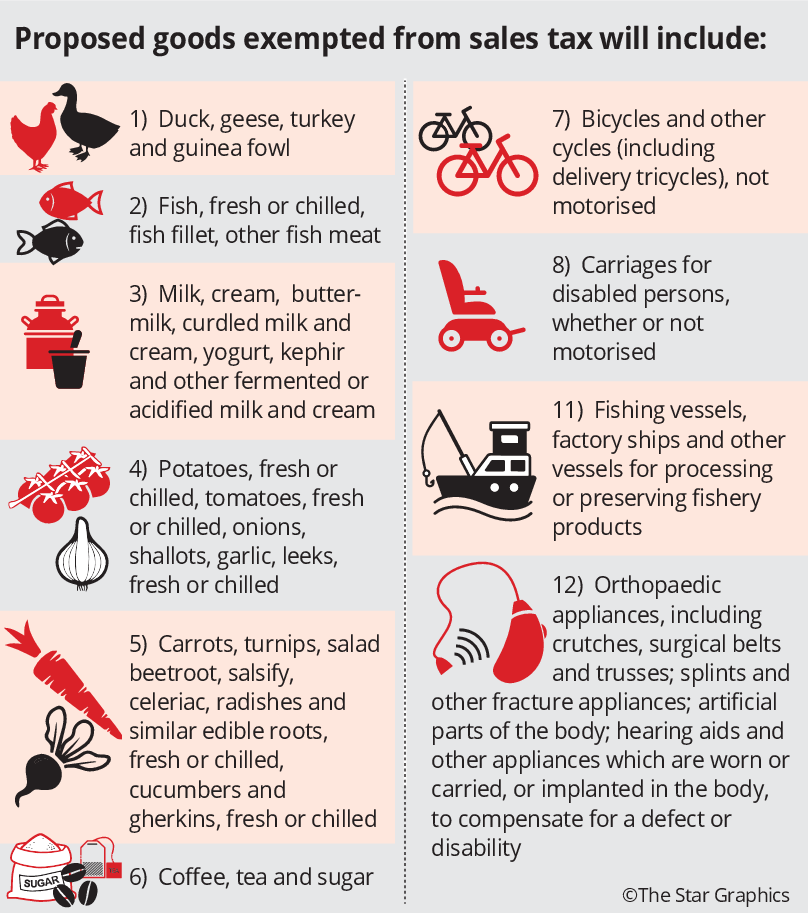

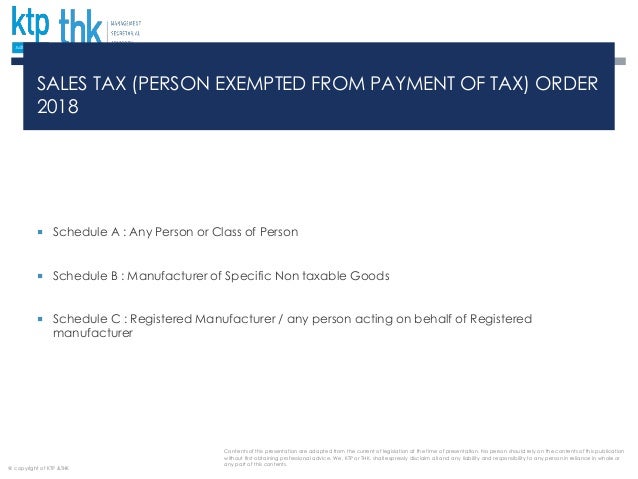

Manufacturer of specific non taxable goods exemption of tax on the acquisition of raw materials components packaging to be used in manufacturing activities. Who are exempted from sales tax. Ruler of states federal of state government department local authority inland clearance depot duty free shop schedule b.

For item 1 2 5 of schedule c sales tax person exempted from payment of tax order 2018. However this exemption does not come automatically you will need to apply for the exemption online. 1 information on tax exemption 2 application for tax exemption.

Schedule a class of person online application. If you fall under schedule a to c of the exempted personel group then you may proceed to apply for tax exemption. Schedule a sales tax exemption from registration order 2018 1.

Malaysia sales sales tax sst error detail not sent by server. Registered manufacturer exemption of sales tax on acquisition of raw materials components packaging etc. There are 3 types of pesonnel that are liable for sales tax exemption in extemption listed of sales tax act 2018.

Sst 02a is due by the end of the following month in which tax is due on imported taxable services i e. There are 2 main ways to apply for tax exemption. I log in to mysst portal www mysst customs gov my registered manufacturer.

To be used in manufacturing of taxable goods replacing cj5 cj5a cj5b. Class of person e g. In the sst 02 return in the taxable period the return shall be submitted no later than the last day of the following month after the.

The frequency of sst 02a declaration differs from sst 02 the latter s frequency is every 2 months. First schedule of the service tax amendments no 3.