Ssm Penalty Late Lodgement

The manager filed the ad on 14 june 2012.

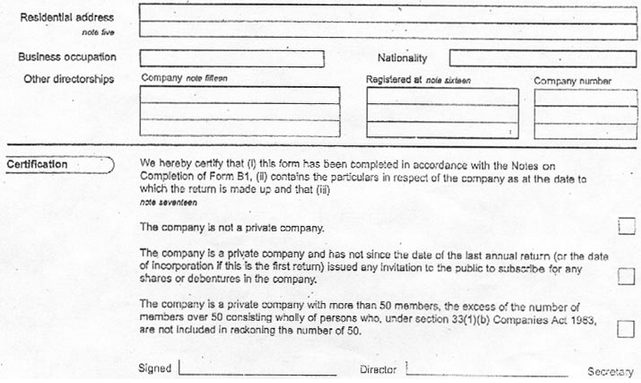

Ssm penalty late lodgement. Under the company law a director can be fined rm30 000 or jailed five years or both if he fails to lodge his company s annual return and audited accounts. The timeframe is not provided for the time to lodge the documents is thirty days from the time the requirement to lodge the document arises. An additional 3 is imposed for the following 30 days.

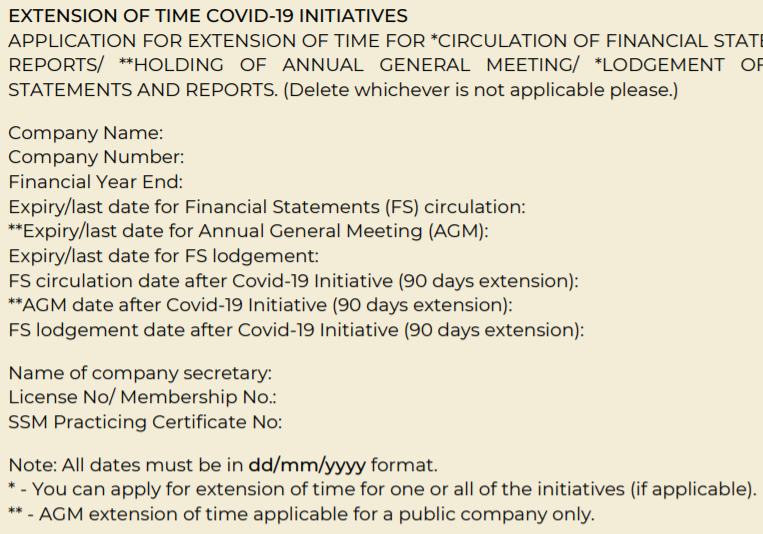

Lodgement of prospectus registered with the securities commission under the capital markets and services act 2007 act 671 under section 154 of the act. We as the registered company secretary and service provider of corporate secretarial services is primarily focus on setting up private limited company. It is learnt that ssm has been tightening its monitoring and enforcement by imposing severe penalty for late or non submission of annual returns and audited accounts.

Therefore the form or return that is lodge to ssm after the period stipulated by the law or regulation shall be accompanied by the following late lodgement fees. With effect from oct 1 2011 the inland revenue board malaysia has been imposing penalties of up to 35 of the tax payable for late filing of tax returns. A late filing fee is a fee imposed on any prescribed forms or returns that are late in its submission deadline to ssm.

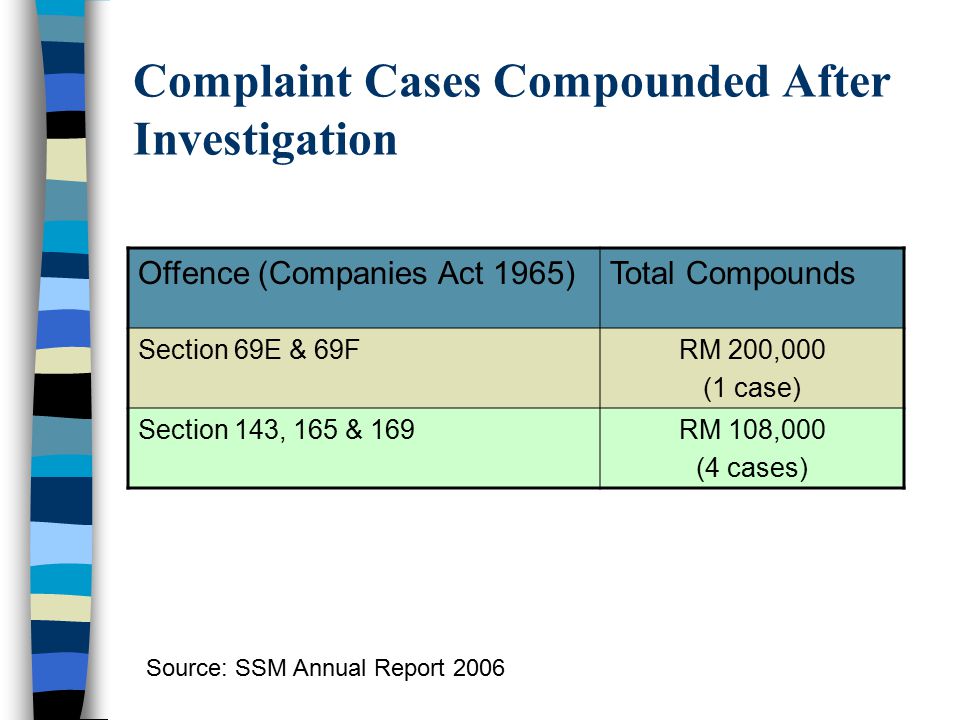

If a document is lodged later that the prescribed timeframe the following late lodgment penalty shall apply. Maximum penalty is rm3mil. Late lodgement fees other than for late lodgement of annual return companies and directors have to comply with a number of statutory obligations under the companies act cap 50 e g.

Abc llp is due to file its ad by 25 may 2012 section 24. Previous regime penalties are dependent on how late is the filing prior to 1 dec 2015 default of each section will incur a penalty composition sum of between 60 350 depending on the length of default. The penalty imposed on the llp is as follows.

Failure to comply is an offence and an appropriate penalty will be imposed for late lodgement. Legal requirement due date to file notification date of notification. Lodgement and application for registration of prospectus under section 155 of the act.

Description penalty for late lodgement of document under s 609 2 by. Late gst payment penalty is 5 within 30 days and an additional 5 after 30 days yet not exceeding 60 days.