Ssm Penalty Late Lodgement 2020

29 56 days 420.

Ssm penalty late lodgement 2020. Failure to lodge ftl on time penalty may be applied if you re required to lodge a return report or statement or both with us by a particular day but don t. Ssm 9 2020 appointment of consultant for research and development on firm of auditors monitoring framework under companies act 2016. Days past deadline late lodgement penalty.

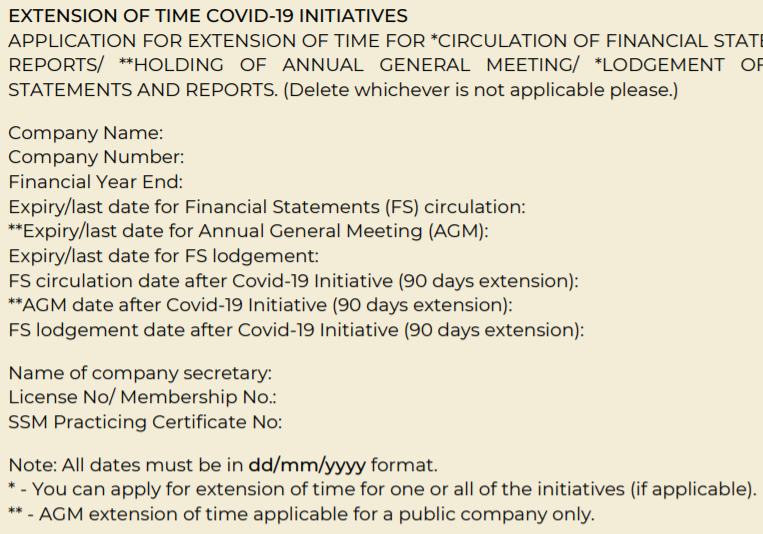

Previous regime penalties are dependent on how late is the filing prior to 1 dec 2015 default of each section will incur a penalty composition sum of between 60 350 depending on the length of default. Lodgement of certificate relating to exempt private company under section 260 of the act. To hold an annual general meeting agm within a given time.

Below are examples of when penalties will be imposed for late lodgement of notifications other than annual declaration example 4. More than 3 months but not more than 6 months rm100 00. Failure to lodge on time penalty.

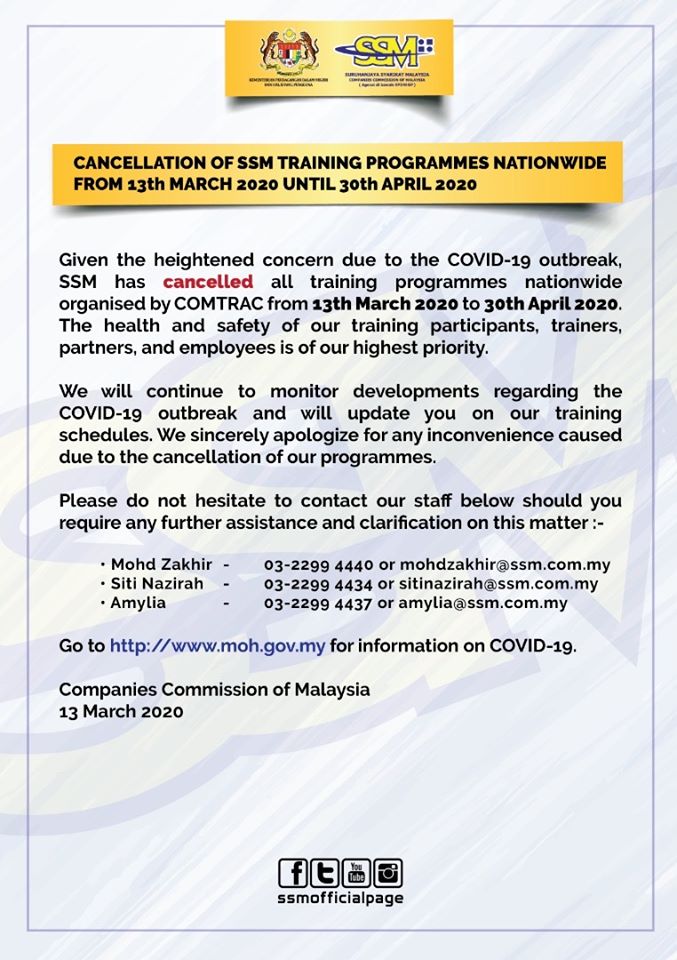

Ssm has on 17 march 2020. 57 84 days 630. More than 7 days but not more than 3 months rm 50 00.

During the moratorium period late lodgement penalty fees will be waived. You must lodge a tax return before tax deadline 2020 if you earned any income between 1 july 2019 30 june 2020 or you may face ato penalties. Companies commission of malaysia ssm announce discounts of 90 on penalties and compounds for the period from 1 1 2020 to 30 4 2020.

Therefore the form or return that is lodge to ssm after the period stipulated by the law or regulation shall be accompanied by the following late lodgement fees late lodgement fees applicable to a private company. 1 28 days 210. Application for extension of time for lodgement of financial statement and report under section 259 of the act.

The companies commission of malaysia ssm recently announced the upcoming launch of a key campaign designed to encourage the corporate community to comply with the provisions of the companies act 1965 and the companies act 2016. Lodgement of notification of new firm of auditors under section 265 of the act. We recognise that sometimes people don t meet their lodgment obligations on time even with the best intentions.

Late lodgement fees other than for late lodgement of annual return companies and directors have to comply with a number of statutory obligations under the companies act cap 50 e g. Companies wishing to apply for an extension of time to hold its annual general meeting more than six months from the financial year end. Penalties for late lodgement.